- In this article, we will talk about the inverse head and shoulders pattern. If you don't know how to trade the inverse head and shoulders chart pattern, then this article will help you a lot. You can increase your knowledge about technical analysis by reading this article.

INVERSE HEAD AND SHOULDERS PATTERN

- The inverse head and shoulders pattern is a popular chart pattern used by technical analysts to signal a potential reversal of a downtrend.

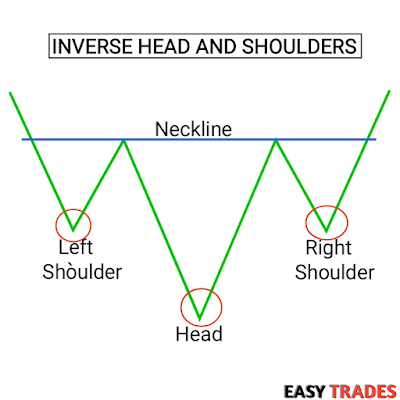

- It is a bullish reversal pattern that appears at the bottom of a downtrend and is characterized by three low points, with the middle low being the lowest, and two higher points on either side. The pattern resembles the shape of a head and shoulders, with the middle low point forming the head and the two higher low points forming the shoulders.

- The inverse head and shoulders pattern is considered to be a reliable signal for a potential uptrend reversal. It can be a useful tool for traders who are looking to enter into long positions in the market. The pattern usually indicates a shift in market sentiment from bearish to bullish.

- The head and shoulders pattern is a common reversal pattern in the financial markets, but the inverse head and shoulders pattern is less commonly seen. The inverse pattern is often considered to be the mirror image of the regular head and shoulders pattern, and it can be formed in any timeframe from minutes to months.

Identifying an Inverse Head and Shoulders Pattern

- To identify an inverse head and shoulders pattern, you should first look for a downtrend. Once you have identified a downtrend, look for three low points that are relatively close in price, with the middle low being the lowest. The two higher low points on either side should be roughly the same height and show a clear support level.

- Once the three low points have been identified, look for two peaks, one on either side of the head, which are roughly the same height and show resistance levels. The distance between the head and the two peaks should be roughly the same, and the neckline should be drawn connecting the two shoulders.

- The neckline is an important level to watch in the pattern. It is the point where the price has to move above to confirm the reversal. The neckline acts as a resistance level during the formation of the pattern, but once the price breaks through it, the neckline becomes a support level.

- Once you have identified the inverse head and shoulders pattern and the price has broken through the neckline, traders often enter into long positions with a stop loss order placed below the right shoulder. The stop loss order helps traders to limit their losses if the pattern fails to complete.

- The profit target is often calculated by measuring the distance between the head and the neckline, and then projecting that distance from the point of the breakout above the neckline. This projection gives traders a rough idea of how far the price might move once the pattern completes.

- In conclusion, the inverse head and shoulders pattern is a bullish reversal pattern that appears at the bottom of a downtrend. It is formed by three low points, with the middle low being the lowest, and two higher points on either side. Traders often look for the pattern to confirm a bullish reversal and enter into long positions with a stop-loss order placed below the right shoulder. The profit target is often projected by measuring the distance between the head and the neckline and projecting that distance from the point of the breakout above the neckline. The inverse head and shoulders pattern can be a useful tool for traders who are looking for potential bullish reversals in the market.

How to trade the inverse head and shoulders pattern?

Entry :

- The entry of the inverse head and shoulders pattern occurs when the price breaks above the neckline.

- Traders may enter a long position as soon as the price closes above the neckline, which confirms the pattern's validity.

- It is prudent to wait for a pullback to the neckline after the breakout to minimize the risk of a false breakout.

- Traders may use technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to confirm the pattern's strength and potential price movement.

Stop Loss :

- A stop loss order is placed below the right shoulder of the Inverse Head and Shoulders pattern.

- The stop loss is used to limit the potential loss if the price does not move in the expected direction.

Target :

- The target for this pattern is typically the height of the pattern added to the breakout point.

- To calculate the target, measure the distance between the neckline and the head and add it to the breakout point.

- Traders can use this target to set their profit targets.

- However, it is important to note that the target should be considered as a potential price target, and traders should be ready to exit their positions if the market conditions change.

SHORT QNAs

1) What is an inverse head and shoulders pattern?

- An inverse head and shoulders pattern is a technical analysis pattern that indicates a potential reversal of a downtrend.

2) What does an inverse head and shoulders pattern look like?

- It appears as three troughs or valleys, with the middle one being lower than the other two, and the two on the sides being of roughly the same height.

3) What is the significance of the neckline in an inverse head and shoulders pattern?

- The neckline is the level that the price needs to break above in order to confirm the pattern and signal a potential uptrend.

4) What is the trading strategy associated with the inverse head and shoulders pattern?

- The strategy is to buy the asset (stock) when it breaks out of the neckline, which is the resistance line connecting the two peaks on either side of the trough.

5) How reliable is the inverse head and shoulders pattern?

- It is considered one of the most reliable chart patterns, but it should be confirmed with other indicators and technical analysis tools before making a trading decision.

6) What is the target price for an inverse head and shoulders pattern?

- The target price is usually calculated by measuring the distance between the neckline and the highest peak of the pattern and adding it to the neckline level.

7) How does the pattern form?

- The pattern is formed when a significant low is followed by a higher low (the left shoulder), then a lower low (the head), and finally another higher low (the right shoulder).

- The neckline, formed by connecting the high points between the shoulders, acts as a resistance level that must be broken for the pattern to be confirmed.

8) How should traders interpret the pattern?

- Traders should look for the pattern to be confirmed by a break above the neckline, followed by a pullback to retest the neckline as support. Traders can then enter long positions with a target price equal to the distance between the head and the neckline.

9) Are there any limitations to the pattern?

- The pattern is not always reliable and can sometimes lead to false breakouts. Traders should use other technical analysis tools to confirm the validity of the pattern, such as volume analysis and momentum indicators.

10) What is the neckline in the pattern?

- The neckline is a horizontal line that connects the high points of the left and right shoulders.

Thanks For Reading The Article....

No comments: