- In this article, we will talk about the double top chart pattern. If you don't know how to trade the double top pattern, then this article will help you a lot. You can increase your knowledge about technical analysis by reading this article.

DOUBLE TOP PATTERN

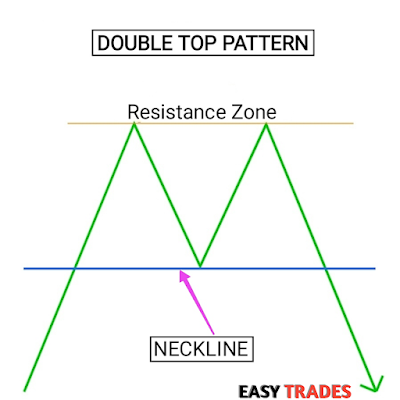

- The double top pattern is a popular chart pattern that technical traders use to predict the potential reversal of an uptrend. This pattern is formed by two peaks that are almost identical in height, with a trough in between them.

- The double top pattern is considered a bearish reversal pattern when it appears at the end of an uptrend. This pattern is formed when a stock or asset reaches a high point twice before reversing its trend and moving lower. The pattern signals that there is strong resistance at the top level, and the demand is not enough to push the price higher.

- The double top pattern is also known as the "M" pattern, as it resembles the letter M on a chart. The pattern can be identified by drawing a line connecting the two peaks, known as the neckline, which serves as a support level.

- Traders who use the double top pattern will often enter a short position once the price breaks below the neckline. The break below the neckline is a confirmation that the pattern has completed and that the price will continue to move lower.

- The target for the double top pattern is based on the distance between the neckline and the highest point of the pattern, projected downwards from the neckline. This target is often used to set profit targets and to determine where to place stop-loss orders.

- While the double top pattern is a popular bearish reversal pattern, traders should be aware that not all patterns will play out as expected. It is important to confirm the pattern with other technical indicators before entering a trade.

- Some traders use other chart patterns, such as the head and shoulders pattern, triple top, as a confirmation of the double top pattern. Others use momentum indicators, such as the Relative Strength Index (RSI), Moving Average Converge/Divergence (MACD) to confirm the bearish move.

- In addition, traders should be aware that the double top pattern can also be a bullish continuation pattern. This occurs when the price breaks above the neckline after the second peak, signaling a continuation of the uptrend.

- To identify the double top pattern, traders should look for two peaks that are almost identical in height, with a trough in between them. The neckline should be drawn connecting the two troughs, forming a support level. Once the price breaks below the neckline, the pattern is confirmed, and traders can enter a short position.

- In conclusion, the double top pattern is a popular chart pattern that technical traders use to predict a potential change in trend. It is important to confirm the pattern with other technical indicators and to be aware that the pattern can also be a bullish continuation pattern. By properly identifying and utilizing the double top pattern, traders can increase their chances of making successful trades.

- The breakout of a pattern is confirmed when the price breaks the pattern with volume.

- The entry point for a Double Top pattern is typically after the price has broken through the neckline, which is a horizontal line connecting the two troughs that form between the two peaks. This neckline serves as a support level, and when it is breached, it signals that the uptrend has come to an end and a downtrend is likely to follow.

- Traders looking to enter a short trade after the Double Top pattern must wait for the price to break below the neckline on high volume or for a confirmation candlestick pattern to form. The most common confirmation patterns include a bearish engulfing pattern, dark cloud cover, or a bearish pin bar.

- It's important to note that sometimes the price may retest the neckline after it has broken through, and this can offer a second entry point for traders who missed the initial entry. If the price retests the neckline and the level holds as resistance, it can provide a low-risk opportunity for traders to short the market.

- In summary, the entry point for a Double Top pattern is typically after the price has broken through the neckline or after a retest of the neckline, following a confirmation candlestick pattern. As with any trading strategy, it's essential to use proper risk management and stop loss orders to manage potential losses.

- In a double top pattern, a stop loss should be placed above the highest point of the second peak.

- This is because if the price breaks above this level, it may signal a reversal and the pattern may no longer be valid. The stop loss helps limit potential losses by automatically closing the position if the price moves against the trader.

- It's important to note that the stop loss should not be too tight, as this may result in premature exits, or too loose, as this may result in excessive losses. Traders should always consider their risk tolerance and account balance when determining their stop loss level.

- The target of a double top pattern is typically measured by taking the distance between the highest point of the pattern to the neckline and projecting that downwards from the breakout point.

- This projected distance is considered to be the minimum price move that can be expected once the pattern is confirmed.

- However, the actual target may vary depending on other key support and resistance levels and market conditions.

SHORT QNAs

1) What is a bearish Double Top pattern?

- A bearish Double Top pattern is a technical chart pattern that indicates a reversal of an uptrend. It consists of two peaks at approximately the same level, separated by a trough.

2) How does a Double Top pattern form?

- A bearish Double Top pattern forms when the price of an asset(stock) rises to a resistance level, then falls back to a support level, only to rise again to test the resistance level a second time.

- However, the second peak fails to exceed the first peak and the price falls below the support level, indicating a bearish trend.

3) What is the significance of the Double Top pattern?

- The significance of the Double Top pattern is that it indicates a potential reversal of an uptrend, suggesting that the price may soon fall. It is a signal to traders to sell their holdings in anticipation of the price dropping further.

4) What are some other characteristics of a bearish Double Top pattern?

- Other characteristics of a bearish Double Top pattern include declining trading volume, a bearish divergence between the price and the technical indicators, and a break below the support level.

5) How can traders use the bearish Double Top pattern to make profitable trades?

- Traders can use the bearish Double Top pattern to make profitable trades by selling their holdings when the price falls below the support level, and placing a stop-loss order above the resistance level to limit their losses.

- They can also look for confirmation from other indicators, such as bearish technical divergence or declining trading volume.

6) What does a Double Top pattern indicate?

- A Double Top pattern indicates that the stock or security has reached a resistance level twice and failed to break through it. It could be a sign of a potential trend reversal.

7) What is the significance of the second top in a Double Top pattern?

- The second top is significant as it confirms the resistance level at that point. If the stock or security fails to break through the resistance level twice, it could indicate a potential trend reversal.

8) What is the target price for a Double Top pattern?

- The target price for a Double Top pattern is calculated by measuring the height of the pattern (from the highest point in the middle of the "M" to the resistance level) and subtracting it from the breakout point (where the stock or security breaks below the support level). The resulting price is the target price for the pattern.

9) What is the stop loss price for a Double Top pattern?

- The stop loss for a double top pattern just above the highest point of the two tops. This is because if the price breaks above this level, it may invalidate the pattern, and the price could continue to rise. The stop loss helps minimize potential losses if the price moves against the expected pattern.

- However, traders may adjust their stop loss according to their risk management strategy and analysis of the market. It is important to note that there is no certain or guaranteed amount that traders should place on their stop loss for the double top pattern.

10) What is the success rate of the double top pattern?

- The success rate of the double top pattern is a 70-75%.

12) The double top pattern is a signal of _____.

- bearish trend reversal

Thanks For Reading The Article...

Read More >>

• Cup and Handle Chart Pattern

No comments: