- In this article, we will talk about the bearish symmetrical triangle pattern. If you don't know how to trade the bearish symmetrical triangle pattern, then this article will help you a lot. You can increase your knowledge about technical analysis by reading this article.

Types Of Symmetrical Triangle Patterns :

- The symmetrical triangle pattern is a bullish and bearish trend continuation chart pattern. As well, this pattern is a bullish and bearish trend reversal chart pattern. It depends on the previous trend and on which side the breakout occurs.

• There are four types of Symmetrical Triangle patterns :

- [A] Bullish Continuation Symmetrical Triangle

- [B] Bearish Continuation Symmetrical Triangle

- [C] Bullish Reversal Symmetrical Triangle

- [D] Bearish Reversal Symmetrical Triangle

- In this article, we will discuss about the bearish continuation symmetrical triangle.

BEARISH SYMMETRICAL TRIANGLE

- A bearish symmetrical triangle is a technical chart pattern that indicates a possible downward trend. The pattern is formed by the convergence of two trendlines, which connect a series of lower highs and higher lows. When the price breaks below the lower trendline, it signals a potential downtrend.

- A symmetrical triangle pattern can be seen on a price chart when the price is making a series of lower highs and higher lows. The upper trendline connects the series of lower highs, while the lower trendline connects the series of higher lows. When these two trendlines converge, they form a triangle shape.

- As the pattern progresses, the price becomes increasingly squeezed between the converging trendlines, indicating that the market is unsure of its direction. This creates a period of consolidation, during which the price may range between the trendlines.

- When the pattern reaches its apex, it signals that a breakout is imminent. A breakout occurs when the price breaks out of the pattern by moving above or below one of the trendlines. In the case of a bearish symmetrical triangle, a breakdown occurs when the price breaks below the lower trendline.

- A breakdown below the lower trendline is a signal that the buyers have lost control of the market, and the bears are taking over. The breakdown is typically accompanied by a surge in trading volume, indicating that there is strong selling pressure.

- Traders can use various technical indicators to confirm the breakdown and identify potential entry and exit points. For example, they may use moving averages to confirm the trend direction or momentum indicators like the relative strength index (RSI) to identify overbought or oversold conditions.

- Traders may also set stop-loss orders above the breakout level to limit their potential losses if the market moves against them. They can set profit targets by measuring the height of the pattern and projecting it downward from the breakout level.

- In conclusion, a bearish symmetrical triangle is a technical chart pattern that indicates a potential downward trend. Traders should look for a breakdown below the lower trendline and use technical indicators to confirm the trend direction and identify potential entry and exit points. Proper risk management is crucial when trading this pattern.

How to trade the bullish symmetrical triangle?

- The breakout of a pattern is confirmed when the price breaks the pattern with volume.

Entry :

- To trade the bearish continuation symmetrical triangle pattern, you must first identify it on a chart. Look for price movement that forms two converging trend lines. The upper trend line should connect two or more price peaks, while the lower trend line should connect two or more price lows.

- When the price approach the apex of the pattern, it is likely to break out in either direction. If you think the price is going to go down, wait for a breakout below the lower trend line.

- Before opening a trade, confirm the breakout using other technical indicators such as the Relative Strength Index (RSI), MACD.

- After confirming the breakout, enter a short position when the price closes below the lower trend line.

Stop Loss :

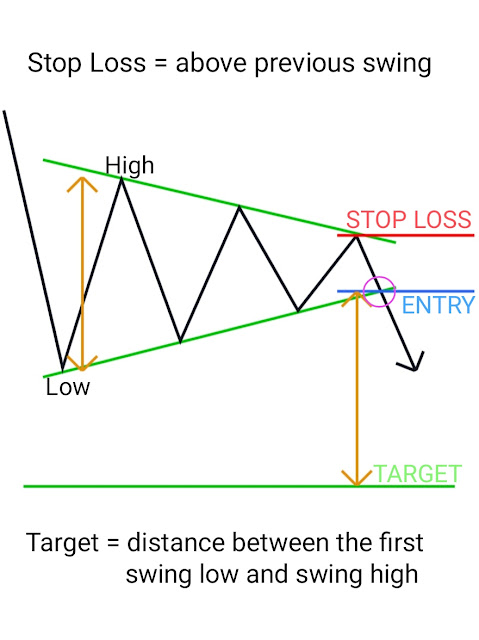

- The stop loss for a bearish symmetrical triangle would be to place it slightly above the upper trendline of the triangle pattern.

- This is because the upper trendline acts as a key resistance, and if the price breaks above it, it could signal a reversal of the bearish trend.

- The stop loss can be adjusted based on the trader's risk management plan and the price action of the asset.

Target :

- To calculate the profit target, measure the height of the triangle pattern from the highest point of the upper trend line to the lowest point of the lower trend line.

- Subtract this measurement from the breakout point to get the profit target.

- To manage the trade, monitor the price movement and adjust the stop loss as the trade progresses. Take profit when the price reaches the profit target or when another technical or fundamental factor suggests exiting the trade.

- The previous trend of the market was down, and after the pattern breakdown, the trend is continuing on the downside.

- Therefore, this pattern is called the bearish continuation symmetrical triangle.

- This pattern is more reliable if the price touches the lower (support) trendline more than three times.

SHORT QNAs

1) What is a bearish symmetrical triangle pattern?

- A bearish symmetrical triangle pattern is a chart pattern that forms during a downtrend and signals a continuation of the downtrend. It is formed by two converging trendlines that connect a series of lower highs and higher lows.

2) How is the pattern recognized?

- The pattern is recognized by drawing trendlines that connect the highs and lows of the price action. These trendlines should converge towards each other, forming a triangle shape. The price action generally moves in a sideways to downward direction within the triangle.

3) What does the pattern signify?

- The pattern signifies that there is a continuation of the downtrend, as the market is struggling to move higher and is experiencing increased selling pressure.

4) How is the bearish symmetrical pattern traded?

- Traders typically wait for a break below the lower trend line to confirm the pattern and enter short positions. Stop loss orders are usually placed above the upper trend line to limit potential losses.

5) What are the potential targets for a trade based on this pattern?

- The potential targets for a trade based on this pattern will depend on the length and depth of the triangle pattern. However, traders can look for a target at the length of the pattern projected downward from the breakout point.

6) What is the stop loss price of a bearish symmetrical triangle?

- The stop-loss price for a bearish symmetrical triangle pattern is typically placed above the upper trendline of the pattern, as a break above this level would indicate a potential bullish reversal.

- However, the exact placement of the stop-loss will depend on the individual trader's risk tolerance, trading strategy, and analysis of the market conditions. It's important to remember that stop-loss orders are just one tool for managing risk, and traders should always conduct thorough research and analysis before making any trading decisions.

7) What are the key characteristics of a bearish symmetrical triangle pattern?

- The pattern is formed by two trend lines that converge towards each other, creating a symmetrical triangle shape. The price action typically bounces between the two trend lines as traders anticipate a breakout to the downside.

8) Are there any limitations to the pattern?

- Like all technical analysis patterns, the bearish symmetrical triangle pattern is not foolproof and can sometimes fail to accurately predict market movements.

- Traders should always use additional analysis and risk management strategies to increase their chances of success.

9) What are some other technical indicators that can be used in conjunction with a bearish symmetrical triangle?

- Other indicators that may be useful include moving averages, relative strength index (RSI), and MACD. These can help confirm the strength or weakness of the underlying trend.

- A bearish symmetrical triangle pattern is formed when there is a downward trend in the price of an asset and the price movement is confined within two converging lines that are at the same angle. The upper trend line connects the lower highs, while the lower trend line connects the higher lows. As the pattern progresses, buyers and sellers become indecisive about the direction of the asset's price. This creates a pattern of lower highs and higher lows, which is indicative of a bearish market sentiment.

- The pattern is confirmed when the asset's price falls below the lower trend line, which signals a strong bearish sentiment. Traders may use this pattern as a signal to enter short positions or to exit long positions. Additionally, the distance between the two trend lines can indicate the potential price target or support levels for the asset, which can help traders determine their risk and reward levels.

11) What is the success rate of the bearish symmetrical triangle pattern?

- The success rate of the bearish symmetrical triangle pattern is approximately 70-80%.

12) The bearish symmetrical triangle pattern is a signal of ______.

- Down trend continuation

No comments: