Inverse Cup and Handle Chart Pattern Explained

- The Cup and Handle pattern as well as the Inverted Cup and Handle pattern are both trend reversal chart patterns.

- In which Cup and Handle is a bullish trend reversal chart pattern.

- And Inverse Cup and Handle is a bearish trend reversal chart pattern.

- In this article, we will discuss about the inverse cup and handle pattern.

- If you don't know how to trade the inverse cup and handle chart pattern, Then this article will help you lot.

- You can increase your knowledge about the technical analysis by reading this article.

INVERSE CUP AND HANDLE CHART PATTERN

- After successfully breakout the cup and handle pattern, the trend is reversed to the downside.

- Therefore, this pattern is called the bearish trend reversal chart pattern.

- when the price goes up, it forms a HH-HL price action.

- bull in the market.

- It means the buyers are stronger than the sellers.

- In the second part (top of cup), the price is consolidated within the range.

- It means there is indecision between the sellers and the buyers.

- Finally, sellers take control from buyers and break the range (consolidation area) to the downside.

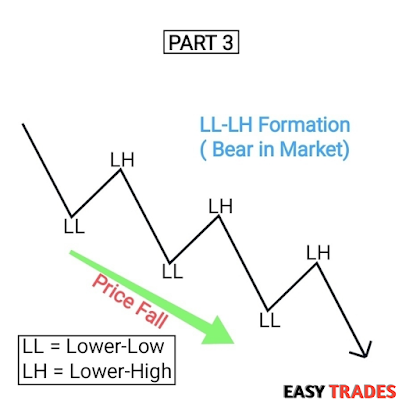

- After breaking the range, the price moves down and forms a LL-LH price action.

- bear in the market.

- It means the sellers are stronger than the buyers.

- Part 2 is the point, where the price action shifts from HH-HL to LL-LH.

Part : 4

- The handle is basically the retracement before the breakout.

• How to trade the cup and handle pattern?

- The inverse cup and handle pattern is activated when the price action breaks below the neckline.

Entry :

- Take entry when price break down the neckline.

Stop Loss :

- SL should be placed above the top of the handle.

Target :

SHORT QNAs

1) What is inverse cup and handle pattern?

- The inverse cup and handle is a technical analysis chart pattern that indicates a change in trend.

2) Is inverse cup and handle bearish pattern?

- Yes, an inverse cup and handle is a bearish chart pattern.

3) What is the opposite of inverse cup and handle pattern?

- The opposite of the inverse cup and handle is the cup and handle pattern, which formed at the bottom.

4) Inverse Cup and handle pattern is a signal of _______.

- bearish trend reversal

5) What is the success rate of inverse cup and handle pattern?

- The success rate of the inverse cup and handle pattern is approx 70-80%.

6) What is inverse cup and handle target price?

- The target price should be equal to the distance between the neckline and the top of the cup.

7) What is inverse cup and handle stop loss price?

- The SL should be placed above the bottom of the handle.

Thanks For Reading Article....... 📝

Read More >>

No comments: